Liontrust

- Home /

- Strategic Partners /

- Liontrust

Liontrust: Who we are

Liontrust is a specialist active asset manager that was launched in 1995, is listed on the London Stock Exchange and has a clear approach to investment. Each of the seven investment teams at Liontrust is focused on:

- Active management

- Distinct, robust and repeatable investment processes

- High-conviction investing (benchmark agnostic)

- Long-term investing

- Engagement with investee companies and clients

Liontrust believes investment processes are key to long-term performance and effective risk control.

The company’s first strategic objective is to enhance the client experience and outcomes, including through investment and insights; access to the investment teams; excellent client service; clear, regular and engaging communications; digital support; and helping advisers achieve their suitability and Consumer Duty responsibilities.

The two teams we highlight here are Sustainable Investment and Multi-Asset.

Sustainable Investment

The Liontrust Sustainable Investment are pioneers of this approach to investing. Since 2001, the Liontrust Sustainable Investment team has used the Sustainable Future investment process to seek companies that help to create a cleaner, safer and healthier world and generate attractive returns for investors through identifying the key structural growth trends that will shape the sustainable economy of the future.

Investment philosophy

The 17-strong Sustainable Investment team applies the Sustainable Future process to the management of equity, fixed income and Managed funds. The team believes:

- The way our economy is developing is not optimal and can be vastly improved by reducing the negative impacts on the environment and inequality in society. They believe that development should be sustainable in that it “meets the needs of the present generation without compromising the needs of future generations” (Rio Earth Summit’s Gro Brundtland).

- Companies that help solve problems, in trying to develop more sustainably and whose products and services we really need, will be more successful than those fighting against these positive trends.

- The market underestimates the quantum of the shift needed to develop more sustainably and the rate of change needed to achieve this.

- By analysing and better understanding these positive trends, the team can identify which companies will experience structural demand for their services as well as identifying those that could experience structural decline.

- Sustainable development issues are very relevant to investors and can have a material impact on returns.

Selecting stocks

The managers identify well-run companies whose products and operations benefit from these transformative changes and which are helping to make the world cleaner, healthier and safer. Further analysis hones this list down to those companies that exhibit superior sustainability management, will deliver persistently high returns on equity and are attractively valued on a five-year view.

Engagement

Engagement is an integral part of how the managers invest. Engaging on key ESG issues gives the managers greater insight, helps to identify leading companies and is used as a lever to encourage better business practices.

Integrating ESG

A key differentiator is the fact all the sustainable elements are fully integrated within a single team. We do not have separate fund management and ESG divisions, for example. Instead, every member is responsible for all aspects of financial and ESG analysis relating to an investment decision. Because of this approach, our team engages with companies across a broad range of issues relating to different stages in our investment process, including screening criteria, sustainable themes and company-specific ESG issues.

SDR labels

All 10 of the UK-domiciled funds managed by the Sustainable Investment team have adopted the Sustainability Focus label under the Sustainability Disclosure Requirements (SDR) from 1 April 2025. This makes it one of the largest ranges of funds to adopt a SDR label, covering equity, fixed income and managed funds. The Sustainability Focus label is intended for a fund that “invests mainly in assets that focus on sustainability for people or the planet”. The Liontrust funds also meet an additional key requirement of the labelling regime by investing at least 70% of their total assets in sustainable investments.

How to access Sustainable Investment - SF Managed Funds

Liontrust offers a range of five Sustainable Future (SF) managed funds. The funds have a range of exposures to asset classes that are determined by the level of risk they take as measured by volatility. SF Defensive Managed is targeting the lowest level of volatility and therefore risk with exposure of between 20% and 50% to equities, while the rest of the portfolio is invested in bonds and cash. SF Global Growth targets the highest level of risk with up to 100% of the portfolio invested in equities. The table shows the risk profile for each fund, the proportion of each portfolio that can be invested in equities and the funds’ ratings from Morningstar and Rayner Spencer Mills.

| Equity allocation (%) | IA Sector | Ratings | |

| SF Defensive Managed | 20 - 50 | IA Mixed Investments (20-60% shares) |

|

| SF Cautious Managed | 40 - 60 | IA Mixed Investments (40-85% shares) |

|

| SF Managed | 60 - 85 | IA Mixed Investments (40-85% shares) |

|

| SF Managed Growth | 60 - 100 | IA Flexible Investments | |

| SF Global Growth | 90 - 100 | IA Global |

Source: Liontrust, 2025.

Download SF Managed Funds sales aid

Insights

You can register to receive insights and updates from the Liontrust Sustainable Investment team. Through this link.

Multi-Asset

Actively Different

ACTIVE MANAGEMENT

- All our Multi-Asset funds and portfolios are actively managed at every stage of the investment process

- They are differentiated from peers through our bespoke Strategic Asset Allocation and active approach

- This is shown through distinct portfolio allocations, holdings, equity and fixed income weightings

- The team invests in funds and passive vehicles from across the whole market

SUPPORT FOR ADVISERS AND YOUR CLIENTS

- Advisers have access to the investment team, regular updates and insights and reporting

- We offer a tailored and white label service to advisers and their clients

- We deliver market leading literature and educational content for advisers to use with their clients

- Liontrust helps advisers to fulfil their responsibilities under Consumer Duty

SUITABILITY

- Liontrust supports advisers in meeting their suitability requirements

- The broad ranges of funds and portfolios enable clients to invest in those with appropriate risk profiles and return objectives

- They provide diversification across asset classes, geographies, fund managers, investment styles, and active and passive vehicle

VALUE FOR MONEY

- The Multi-Asset team benefits from the knowledge and insights of the six single strategy teams at Liontrust

- Costs are kept to a minimum and charges are competitive

- We focus on client outcomes and enabling advisers to provide the highest quality advice

Investment process

The Multi-Asset process is designed to target the outcome expected by investors in terms of their level of risk, as measured by volatility, and maximise the return for each fund and portfolio within the appropriate risk band.

There are five stages to the Liontrust Multi-Asset investment process:

- Bespoke Strategic Asset Allocation (SAA)

- Tactical Asset Allocation (TAA)

- Strategy selection

- Portfolio construction

- Monitoring, review and risk management

Every stage of this process is actively managed. For example, while the majority of the underlying vehicles within the Dynamic Passive funds and portfolios are passive, the decision as to which ones to include and in what proportions are still active decisions.

Active enhancements are made where we believe this will benefit the management of the funds and portfolios. We enhanced the SAA in 2023 to ensure we could meet the challenges and opportunities posed by our belief that investing over the next few years will be different from the last 15 years. We are facing an unprecedented political environment, including fragmentation of globalisation, which will impact economics and markets.

The Liontrust Multi-Asset team actively engages with the managers of the underlying holdings within their funds and portfolios.

Investment beliefs

- Consistency of process

- Markets are not fully efficient

- Long term markets follow fundamentals

- Active asset allocation exploits short term mispricing

- Patience – time in the market, not timing the market

- Better to prepare for markets than react to them

- Multiple layers of diversification

- Governance, liquidity and risk management

Multi-Asset team

The seven-strong investment team has extensive experience of Multi-Asset, equity and fixed income investing, with an average of more than 22 years in the industry. Collectively, they have managed funds and portfolios for many decades through different economic and market cycles, and each member contributes to every stage of the investment process. The team was enhanced by the integration of the Liontrust Global Fixed Income (GFI) at the start of 2025 and benefits from being able to tap into the knowledge, insights and experience of the other investment teams at Liontrust, who primarily invest in equities.

The team is headed by John Husselbee, who joined Liontrust in 2013 and was previously a co-founder and CIO of North Investment Partners, Director of Multi-Manager Investments at Henderson Global Investors, and NM Rothschild & Sons.

James Klempster, Deputy Head and Head of Equities, joined Liontrust from Momentum Global Investment Management, where he led to global investment team and solutions strategy for a global client list including institutional and retail clients.

Phil Milburn, Head of Credit, joined Liontrust in January 2018 from Kames Capital, where he had spent over 20 years, launching one of the market’s first strategic bond funds in 2003 and developing a leading high-yield franchise. Donald Phillips, Head of Credit, moved to Liontrust in February 2018 from Baillie Gifford, where he had co-managed the European high yield strategy from 2010.

Anthony Chemla, who moved to Liontrust in April 2023 from atomos where he was lead Portfolio Manager for DFM portfolios and Co-Portfolio Manager of the MPS, and Sharmin Rahman (Investment Manager), who joined in August 2022 having previously been a Senior Portfolio Manager and Analyst at AXA Investment Managers, are both Investment Managers. Fund Analyst David Salisbury joined in 2022 from 4 Shires Asset Management.

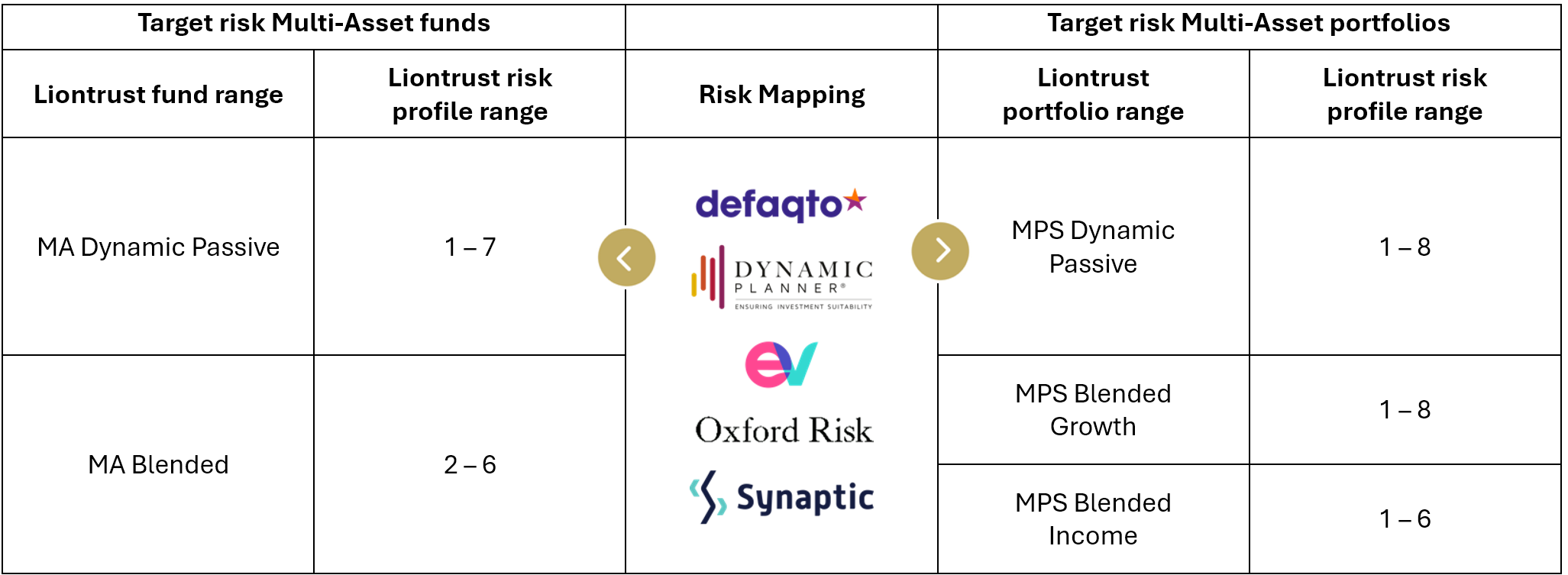

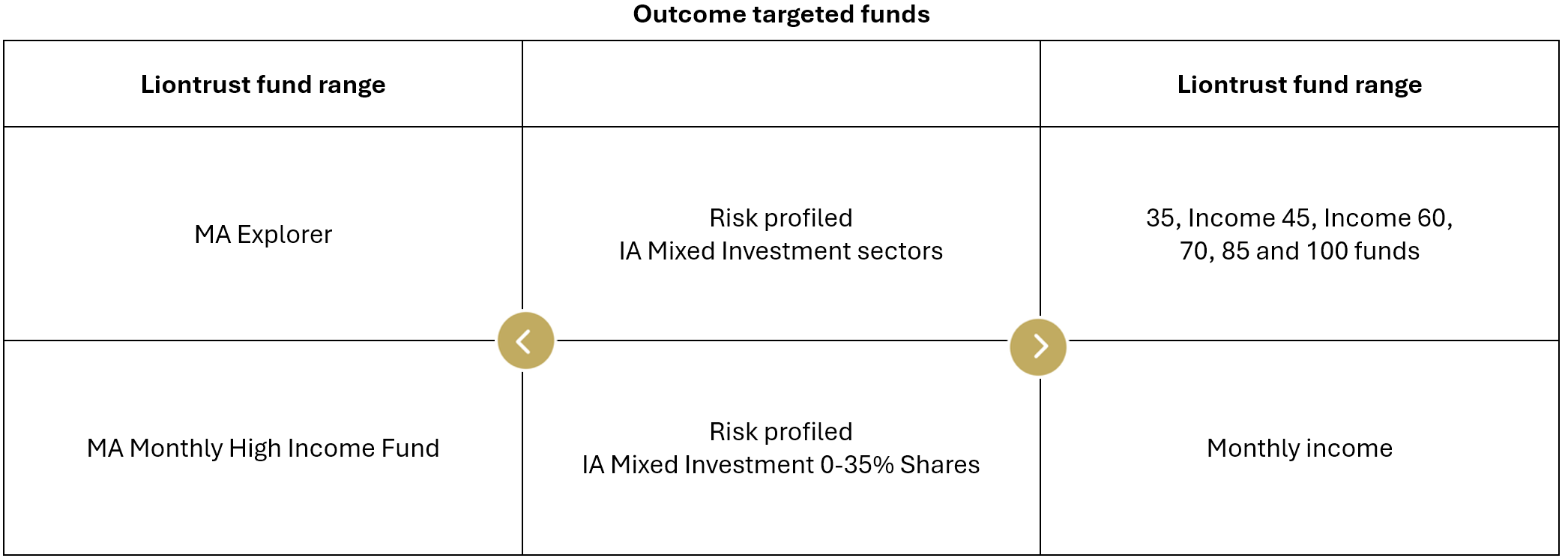

How to access Multi-Asset solutions

There are many ways in which advisers can access the Liontrust Multi-Asset solutions, depending on their clients’ risk profile, return objectives, preference for active and passive investments, growth or income, funds or portfolios.

Client support

Download

A Guide to Managing Volatility

Quarterly Performance Review and Outlook

Further guides

Insights

You can register to receive insights and updates from the Liontrust Multi-Asset team through this link.