A well-needed healthcare solution

Mike Allison

11 March 2022

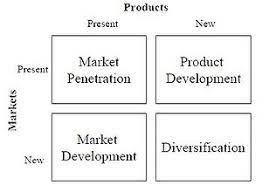

Of course, there are sometimes many barriers to entry into some markets and levels of expertise in some that we just cannot hope to achieve at the right time. However, where there is demand within a market, and levels of expertise and process are not too far removed from those exhibited in our own marketplace, then surely there is a time when you should explore expanding a portfolio of products to customers.

One such area that is attracting considerable attention at the moment is healthcare. In terms of demand from consumers, it appears as though the interest in private healthcare has risen steadily over the period of the pandemic.

One specialist I spoke to recently said they had moved from producing 8,000 to 9,000 quotes per month pre-pandemic to 23,000 to 24,000 now. Insurers are also telling me that ‘first-time sales’ among advisers are accounting for significant numbers of their business.

If we look at mortgage advisers, they may feel - given a higher proportion of income may be being derived from product transfers as opposed to purchases and remortgages - this will hit them in the pocket harder than previously, and therefore they may be looking for new avenues of revenue to fill that gap. Buy why healthcare and why now?

One simple response is NHS waiting lists. Under the NHS Constitution, if your GP refers you for a condition that's not urgent, you have the right to start treatment led by a consultant within 18 weeks from when you're referred, unless you want to wait longer or waiting longer is clinically right for you.

In December of 2021, the number of people forced to wait more than 52 weeks to start non-urgent treatment was 310,813, up from 306,996 in the previous month and 39% higher than in December 2020. A total of 20,065 had waited for more than two years. Overall, 92% of patients waiting are those meant to be treated within 18 weeks.

This means that many people are suffering as a result of the strains put on the NHS during the pandemic and will continue to do so for some while. In total according to recent reports over six million people were waiting for treatment.

You may have also seen recently that that the survival rates for cancer had reached 50% for the first time and we should not forget the considerable cost of ongoing care for cancer patients and the costs they incur as a result. This, at a time when pressures are about to increase on personal budgets due to inflation, which is at its highest recorded level in decades, in addition to other price rises due to hit shortly – namely:

- Energy bills - the cost of energy has risen because of the high price of wholesale gas and of producing electricity at the moment. There is a price cap to limit the amount energy suppliers can charge per unit of gas and electricity. This cap is set to rise by £693 in April.

- Food prices - food and non-alcoholic drink prices rose by 4.2% in 2021. There is the possibility they will rise further in 2022.

- National insurance - anyone earning income in the UK may need to pay National Insurance. This includes employed and self-employed people. The UK Government has confirmed that National Insurance will rise in April 2022.

- Council Tax - many local authorities in England are planning to increase Council Tax payments in 2022 to balance their spending during the pandemic.

- Rail fares and petrol prices - train fares in England, Scotland and Wales are increasing by up to 3.8%. The cost of petrol and diesel have also been impacted by a rising cost in oil prices.

Of course, like it is with many protection-based products, you can choose to work with your customers yourselves or for those who want to pass to a specialist, many support service businesses such as Paradigm have referral partners to ensure clients continue to get a whole of market service.

It may not be a solution for all advisers but as clients read and hear of the daily issues faced by the NHS it is certainly one way to support them in delivering a solution in what clearly is a grave, and ongoing, crisis in healthcare.