intelliflo - Uncovering the advice gap; the Advice Map of Britain

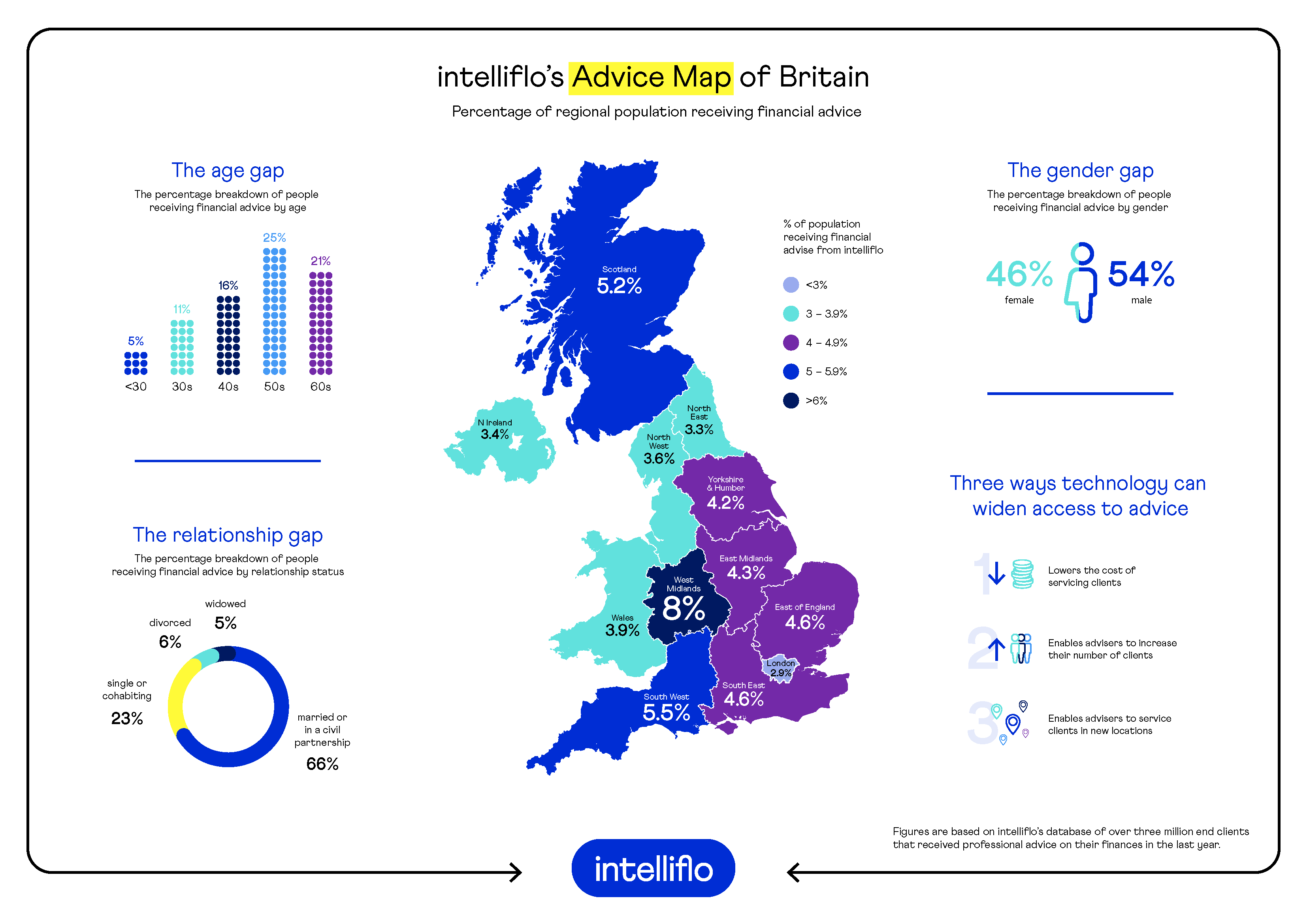

To get a clearer picture of who is currently taking financial advice, we recently undertook detailed analysis of our database of over three million financial adviser clients. Our inaugural Advice Map of Britain found that engagement with personal finance advice varies considerably across the UK depending on your age, your gender and even your relationship status.

The Wealth Problem

Most will recognise from their own client base that people are more likely to receive advice as they get older. Close to half advised clients are over 50, but just one in twenty is under 30.

There’s a common belief that people need a certain level of wealth before they take professional advice. Our age data certainly seems to support this idea, as the over 50s are more likely to have accumulated wealth and be ready to plan their long-term finances. The expense of delivering regulated advice, including soaring regulatory and insurance costs, have resulted in increases in the minimum assets clients need before advisers are prepared to take them on. A survey by Canada Life2 in 2019 found that just 16% of advisers would take on a client less than £100,000 in investible assets, down from 50% in 2014.

Our data also found that your likelihood to take advice varies by your relationship status. Two thirds of those people getting advice are married or in a civil partnership, compared with a quarter that are single or cohabiting. Again, this imbalance might be linked to having more assets as we get older. According to the latest ONS data3, the average age to get married or enter a civil partnership in the UK is now over 35, which could mean that many single people are still building their wealth. Marriage often coincides with other life changes too, like buying property and having children, which can focus the mind on the future and long-term financial considerations.

The Advice Map analysis revealed a marked gender gap as well, with those receiving professional financial advice split 54% men to 46% women. There has been a great deal of publicity in recent years about the gender pay gap – analysis of pay gap reports by the Financial Times4 indicates that women are paid 87p for every £1 paid to men. And this inequality of earnings translates into an imbalance of wealth. The Pensions Policy Institute5 found that men in their 60s have three times more retirement savings than women.

Barriers to advice

But although how much money you have is clearly a factor in whether you take advice, it’s not the whole story. OpenMoney’s advice gap research suggests that another key reason people don’t take advice is that they feel it costs too much. This is a particular concern for women, with 20% identifying it as an issue, compared to 14% of men.

And many other factors contribute to the advice gap problem, like lack of trust and confidence in the industry, low awareness of the benefits of taking advice and not knowing where to find it.

However, there is evidence that younger people are becoming more willing to take advice. Research from Prudential6 a year into the pandemic found that 74% of millennials (aged 25 to 40) had seen an adviser or were planning to do so. And OpenMoney found that younger people are becoming less price-sensitive, with just 11% of the 18 to 24 age group identifying cost as a reason for not taking advice, compared to 25% in 2020. It could be that the disproportionate impact of the Covid crisis on young people’s finances has highlighted the benefits of financial planning.

Bridging the Gap

So how can advisers capitalise on this growing interest and broaden their reach to new audiences that will benefit from professional advice? Technology has an important part to play in delivering service to a greater number of clients, with potentially lower investible assets, cost-effectively and efficiently.

Some advice firms are now looking at developing a digital advice platform, delivering simplified advice to those with lower assets via online questionnaires. But you don’t need to go down the ‘robo’ route to benefit from technology. Throughout the pandemic, clients have become used to using personal finance software systems with their advisers, including personal message management portals, virtual meeting technology and electronic signatures.

Using these tools on an ongoing basis can save time, money and resource, creating business efficiencies while also delivering a better service to clients. The intelliflo e-Adviser Index, which analyses how firms utilise intelliflo office, shows that those making best use of the functionality generate 48% more revenue and 82% more ongoing revenue per adviser than those who do not. In addition, those using the technology to its maximum potential have 23% more clients and 98% more assets under management than those with the lowest adoption.

The advice gap in the UK is a complex issue. There are many reasons why people don’t take personal finance advice, but with greater efficiency, automated processes and remote servicing where appropriate, advisers can broaden their client reach and lower the cost of delivering advice and in do so, widen access to professional financial planning and help close the advice gap.

Sophisticated yet easy to use, intelliflo’s powerful technology is crafted to help you save time and cut costs, so you can focus on driving your business forward. Our range of cutting-edge solutions supports over 30,000 financial professionals worldwide. Discover how we can help you, your team, or your clients at www.intelliflo.com

Schedule a demo

1 https://www.open-money.co.uk/advice-gap-2021

2 https://www.ftadviser.com/your-industry/2019/08/07/drop-in-advisers-accepting-100k-clients/

3https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/marriagecohabitationandcivilpartnerships

/bulletins/marriagesinenglandandwalesprovisional/2018

4 https://www.pru.co.uk/pdf/press-centre/210311-financial-advice.pdf

5 https://www.whatinvestment.co.uk/womens-saving-and-investing-is-far-less-than-mens-2618135/

6 https://www.pru.co.uk/pdf/press-centre/210311-financial-advice.pdf