What makes us different?

MetLife Europe d.a.c. is an affiliate of MetLife, Inc. and has been in the UK since 2007, providing innovative protection, employee benefits and retirement solutions.

MetLife, Inc. has established a strong presence through organic growth, acquisitions, joint ventures and partnerships in over 40 countries worldwide and is trusted by tens of millions of customers1.

In the UK, we offer two accident and health products - EverydayProtect and MortgageSafe. Discover more below.

We pride ourselves on:

Efficiency and flexibility Efficiency and flexibilityBoth EverydayProtect and MortgageSafe Individual Protection policies aim to cover the majority of clients immediately, via quick and simplified online applications. |

|

Innovation and simplification Innovation and simplification Our commitment is to provide innovative and simple products which focus on increased accessibility and inclusivity for clients. |

|

Trust and expertise Trust and expertiseOur UK based operations deliver proven excellence in claims and service, delivering on our promises when it really matters. |

Whether your clients are first-time buyers or returning to the property market, it’s important for them to protect one of their most valuable assets; their home.

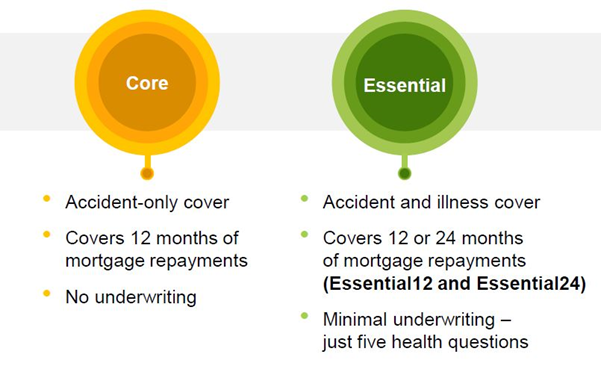

MortgageSafe is our accessible, flexible, affordable policy, that protects mortgage repayments if your client has an accident or is ill and can’t work, so isn’t earning their usual income as a result.

MortgageSafe makes your client’s monthly repayments from the first day they’re unable to work. There’s a short four-week waiting period, no underwriting on our accident-only policies, and our accident and illness policies are available for 12- or 24-months. What’s more, it can cover 110% of the monthly repayment value, up to a maximum of £1,500.

More confidence for more clients

Everyone should have a financial safety net in case the unexpected happens, but there are some who need it more than others. If any of your clients:

- Have a limited protection budget

- Have little or no sick pay, or only get statutory sick-pay

- Don’t have much in savings

- Have a low disposable income

- Have a pre-existing medical condition

… MortgageSafe could provide the financial protection they need to keep paying their mortgage.

MortgageSafe also offers Optional Child Cover:

Families can choose to add Optional Child Cover onto their policy for an additional £3 per month.

It isn't linked to the mortgage. It’s simply there to help families get back on track and manage any unexpected costs associated with child accidents and illness.

MortgageSafe at a glance:

- A unique simplified income protection proposition

- With three simple cover levels

- Has a smooth, digital application with immediate cover available

- Features a simplified set of 5 health underwriting questions and no financial underwriting

- Offers a straightforward claims process

- Includes Optional Child Cover for families

To find out more, download the MortgageSafe brochure here.

Discover more about MortgageSafe

For the latest literature, guides and testimonials visit: www.metlife.co.uk/get-more-with-mortgagesafe/Core Cover

EverydayProtect is the essential protection policy that completes your clients' protection packages. It’s the flexible, budget-friendly policy that can protect individuals and their families against the risks they face every day.

EverydayProtect provides financial support 24/7 worldwide for a range of accident and health risks, including broken bones, non-accidental death, and UK hospitalisation – which also covers sickness once cover has been held for at least 12 months, and pregnancy-related complications for hospital stays of at least four complete and uninterrupted days.

Optional cover

Because of the range of optional cover available, tailoring protection to your individual clients is really straightforward. Options include:

- Child Cover for those with children

- Active Lifestyle Cover which covers accidental dislocations, tendon ruptures, and ligament tears for clients who are more physically active

- To find out more, download the EverydayProtect brochure here.

With EverydayProtect, clients can claim for multiple injuries, and the number of claims they make won’t affect their policy or premium in the future.

EverydayProtect offers:

- Simple, non-underwritten accident and illness policies

- Budget-friendly cover starting from just £10 per month

- Additional cover options start from just £1 per unit per month

- A straightforward claims process, with prompt lump-sum payments

- A smooth digital application process, with immediate cover available

- Entry between 18th and 65th birthdays

- Cover until the client’s 75th birthday

- Access to MetLife's Wellbeing Support Centre

Discover more about EverydayProtect

For the latest literature, guides and testimonials click here.

At MetLife we pay an average of 95 accident and illness claims every day*

To find out more, download our interactive Claims Case Study Booklet here.

Speak to the team about how you can get started:

Call us: 0800 917 2221 or email us: [email protected]

Please state that you are a Paradigm Protect member. Your dedicated MetLife Account Manager will contact you to set up your MetLife agency.

Sources:

*MetLife protection portfolio period 1st January to 31st December 2023 inclusive. Figures based on UK working days during this period.

Products and services are offered by MetLife Europe d.a.c. which is an affiliate of MetLife, Inc. and operates under the “MetLife” brand. MetLife Europe d.a.c. is a private company limited by shares, registered in Ireland under company number 415123. Registered office at 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. UK branch office at Invicta House, Trafalgar Place, Brighton BN1 4FR. Branch establishment number: BR008866. MetLife Europe d.a.c. (trading as MetLife) is authorised and regulated by Central Bank of Ireland. Authorised by the Prudential Regulation Authority in the UK. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority in the UK. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

- 0800 917 2221

- Visit Website

Links

Contact us

Protection sales team:

0800 917 2221

[email protected]

Customer Services & Loyalty team:

0800 917 0100

[email protected]

Claims team:

0800 917 1333

To register a new claim - Option 2

For ongoing claims - Option 3

[email protected]

Underwriting team:

0800 917 1888

[email protected]

- MetLife EverydayProtect website

- MetLife MortgageSafe website

- MetLife Online Services

- MetLife Case Study Booklet

- MortgageSafe Terms & Conditions

- MortgageSafe Policy Summary

- EverydayProtect Terms & Conditions

- EverydayProtect Key Facts Policy Summary