How do we invest in the ESG themes range

ESG Themes portfolios – how do they work?

The aim of the ESG Themes portfolios is to deliver financial returns while at the same time making a positive impact on the planet and society. Our ESG range invests some of your money in ‘themes’ that have specific goals to help contribute to a better world.

These thematic investments sit within the equity part of the portfolios. They’re invested in ‘solution-focused’ businesses, i.e. businesses focused on developing solutions to solve either environmental issues or social problems. The ESG Themes portfolios use investments linked to the six different environmental and social areas, shown in the diagram below.

Chart 1: The ESG Themes portfolios invest in six key themes that seek to make either an environmental or societal impact.

Source: M&G Positive Impact team

‘Environmental solutions’, for example, is about alternative energy and companies developing more energy-efficient components. Investing in the ‘circular economy’ theme is about reducing waste and recycling and reusing resources. Social purpose concentrates on better health, better working conditions and working towards greater social equality.

Why do we invest in themes?

We believe investing in ‘solution-focused’ themes can not only contribute to a better world but also lead to strong investment performance. The reason being is that companies providing solutions to environmental and social problems will likely be rewarded by the global economy in the future. That’s why we look for parts of the market where companies are innovating and new industries are being created to help solve global challenges.

Importantly, the themes we invest in are underpinned by long-term trends. Trends are large social, economic, political, environmental or technological transformations that generally unfold over decades, rather than months or years. We select themes to invest in based on how the companies involved can benefit from long-term change. People tend to underestimate the strength, duration and persistence of trends. As a result, the long-term growth of companies exposed to such trends is often underestimated.

Focusing on ‘growth’ areas

Within each theme, these companies are concentrated in specific areas. For example, the funds in the portfolios that target climate action will hold more companies that are involved in renewable energy technology. Conversely, the funds that target improved access to water will hold fewer companies within the renewable energy sector, but more in the utilities and industrials sectors.

By combining six different themes in this way, we’re able to target a broader set of positive industries and, from an investment point of view, have a diversified portfolio where no single theme carries too much risk.

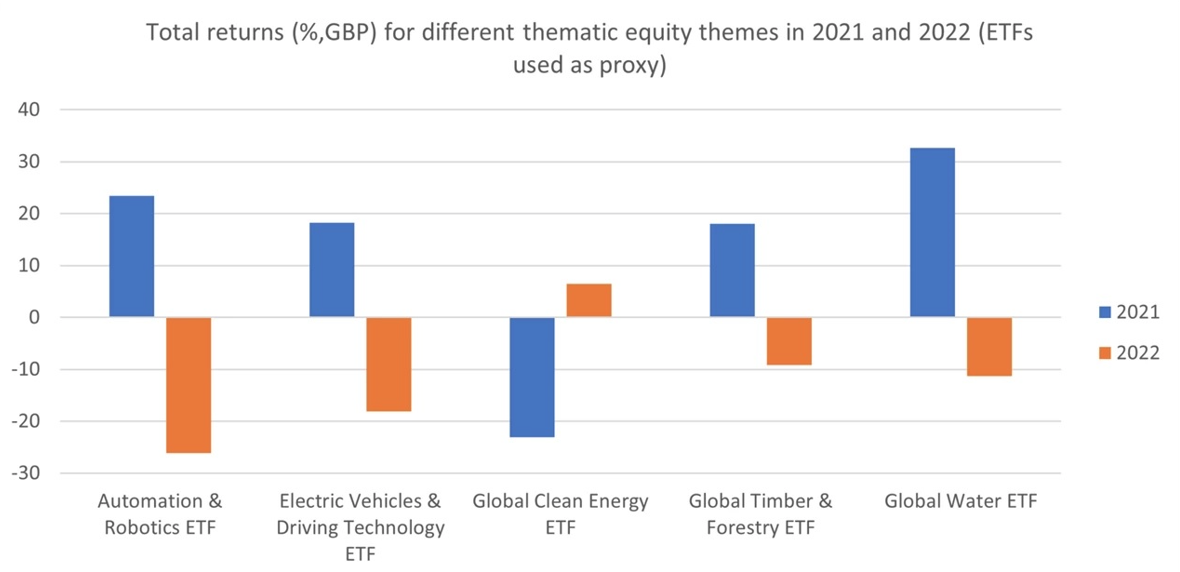

2022 and 2021 serve as prime examples of this. The chart below shows the investment returns of five different funds that provided exposure to different equity themes in 2021 and 2022. These funds aren’t held in the ESG Themes portfolios but represent some of the themes these portfolios are exposed to.

The bars’ height indicates the returns in 2021 and 2022. The factors influencing the stock market in 2021 were very different to those in 2022, which led to considerable differences in performance and shows how investing in several different themes can help to diversify the portfolios.

Chart 2: A comparison of different thematic ETFs in 2021 and 2022 (% total return and in GBP)

Source: FactSet data. Note these funds are not held in the ESG Themes portfolios but are representative of some of the themes we invest in. Past performance isn’t a guide to future performance.

Why do we invest in active funds?

All our investments in equity themes are in ‘active’ funds. These are funds that take a more hands-on approach to identify individual companies that can offer attractive investment opportunities. This contrasts with passive funds, which simply track a market index, such as the FTSE 100 Index.

A lot of sustainable funds, including passive sustainable funds, simply exclude the companies who are creating problems for society and the planet. Our approach is to invest in funds that are also providing solutions and whose impact can be measured.

Our investment team assesses the objectives of each fund and evaluates whether the contribution it’s making would have happened anyway. For example, the Robeco Gender Equalities fund aims to invest in companies that actively promote gender equality. The fund managers use a scoring system comprised of several factors, such as board diversity, workforce diversity, pay equity and employee well-being. The fund actively engages with companies it invests in with the aim of improving these scores. This is a good example of how investors can have a positive impact on society through their investments.

Finally, simply providing exposure to a theme isn’t enough. Companies also need to be well managed and innovative. Determining which companies will succeed requires thorough analysis of their business models, company management and competitive advantages. By using active funds, this helps ensure that we own the right businesses within our themes.

The ESG Themes range was launched last year and has just gained its one-year performance track record. The portfolios are an attractive option for those seeking long-term returns from their investments, while looking to contribute towards a healthier world.

With investment, your capital is at risk and you may get less than you invested. Tax treatment depends on your individual circumstances and may change in the future. If you are unsure about investing you should speak with a financial adviser.